Frequently Asked Questions on EMV Credit Cards

Last October, the liability for credit card fraud shifts from the card issuers to the merchants unless they replace their card processing systems to ones that use more secure chip-enabled devices. The push to migrate to more secure EMV card payment technology was due to the increasing number of incidents related to PoS RAM scrapers and credit card fraud in the United States. In fact, the U.S. has the highest number of PoS RAM Scraper cases in the world—a rank that's likely because most countries are already using EMV Cards. The move should ultimately reduce the number of credit card fraud cases.

We've gathered a number of common questions new users might ask with regards to this new payment system:

What does EMV mean?

EMV stands for Europay, Mastercard, Visa. These three brands created the EMV consortium in 1994 to develop new payment processing technologies to counteract payment fraud.

What’s the difference between a regular credit card and an EMV, or Chip-and-Pin card?

A regular credit card is a plastic card that has a magnetic stripe at the back that stores static credit account information. The EMV card features a microchip that doesn't just store static information, but a unique code for each transaction as well.

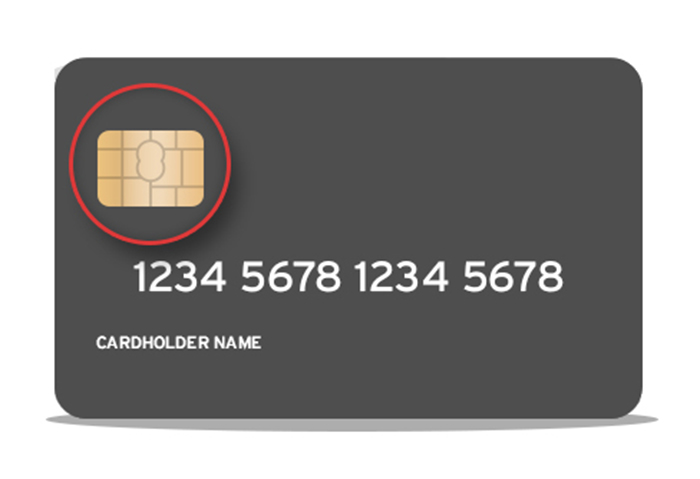

What does an EMV card look like?

An EMV card has an embedded chip that's easily visible on the card's front.

An EMV card has an embedded chip that's easily visible on the card's front.

How does an EMV transaction work and how is it safer?

EMV cards feature a chip that stores a cryptogram that allows banks to determine if the card or a transaction is modified. The chip also has a counter that gets incremented with each transaction to make sure no duplicate transactions are made. Like credit cards, the EMV also requires a PIN input before each transaction.

I still don’t have an EMV card and the deadline has passed. What should I do?

Contact your credit card issuer and ask if they are in the process of switching to EMV. While the liability for fraud shifts from the credit card issuer to the retailers, it's still in a card issuer's best interests to secure their systems. Credit card fraud will still cost them one way or another.

Are there drawbacks to the EMV card?

While EMV cards are designed to prevent fraud from skimming and duplicated magnetic stripe cards, they're still susceptible to PoS RAM Scraper malware. While the EMV card's built-in defenses will still make it tough—if not impossible—for a fraudster to make transactions without your card and PIN code, the malware can still be used to steal some information from the card through an infected PoS machine.

Click the link to learn more about EMV cards and other next-gen payment processing technologies.Like it? Add this infographic to your site:

1. Click on the box below. 2. Press Ctrl+A to select all. 3. Press Ctrl+C to copy. 4. Paste the code into your page (Ctrl+V).

Image will appear the same size as you see above.

Artículos Recientes

- Forecasting Future Outbreaks: A Behavioral and Predictive Approach to Proactive Cyber Risk Management

- Fault Lines in the AI Ecosystem: TrendAI™ State of AI Security Report

- The Industrialization of Botnets: Automation and Scale as a New Threat Infrastructure

- From Holiday Snap to Custom Scam in 30 Minutes: How AI Turns Public Photos Into Targeted Attacks

- From LinkedIn to Tailored Attack in 30 Minutes: How AI Accelerates Target Profiling for Cybercrime

Fault Lines in the AI Ecosystem: TrendAI™ State of AI Security Report

Fault Lines in the AI Ecosystem: TrendAI™ State of AI Security Report AI Security Starts Here: The Essentials for Every Organization

AI Security Starts Here: The Essentials for Every Organization Ransomware Spotlight: DragonForce

Ransomware Spotlight: DragonForce Stay Ahead of AI Threats: Secure LLM Applications With Trend Vision One

Stay Ahead of AI Threats: Secure LLM Applications With Trend Vision One